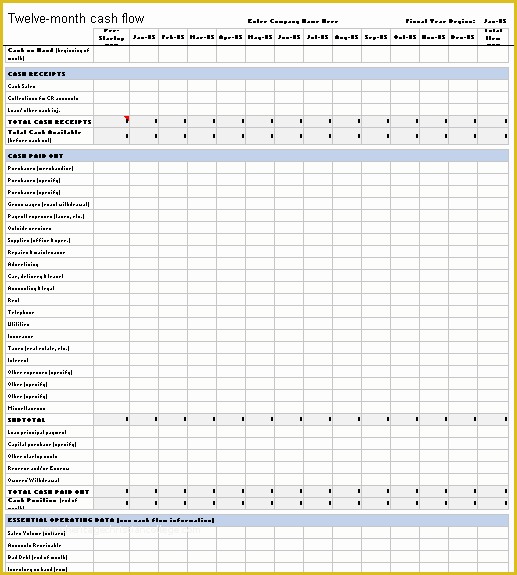

If you are applying for loans, banks will likely have their own personal financial statement (PFS) forms for you to fill out (I've linked to a couple in the references at the bottom of this page). They can get that information from your personal financial statement. One of the ways they do that is by analyzing your income and how much debt you currently have. Why is a PFS useful for creating and evaluating a budget?Ī lender needs to evaluate the risk of lending money to you. The higher this ratio the less financial flexibility you have. Debts-to-Assets Ratio = Total Liabilities / Total Assets :: Indicates the degree of leverage that is used by a person or company to finance their assets.It should be below about 35% to be considered to have an acceptable level of debt. Debt-to-Income (DTI) Ratio = Annual Debt Payments / Annual Income :: A ratio commonly used by lenders to determine how risky of an investment you will be.It's one of the really cool things that your PFS can tell you. Basic Liquidity (BLR) Ratio = Total Liquid Assets / Total Living Expenses :: How many months can you live on your liquid assets without any income? This ratio uses info from both the balance sheet and the cash flow statement.It also includes calculations for some common financial ratios: names and addresses of the applicant and co-applicant).

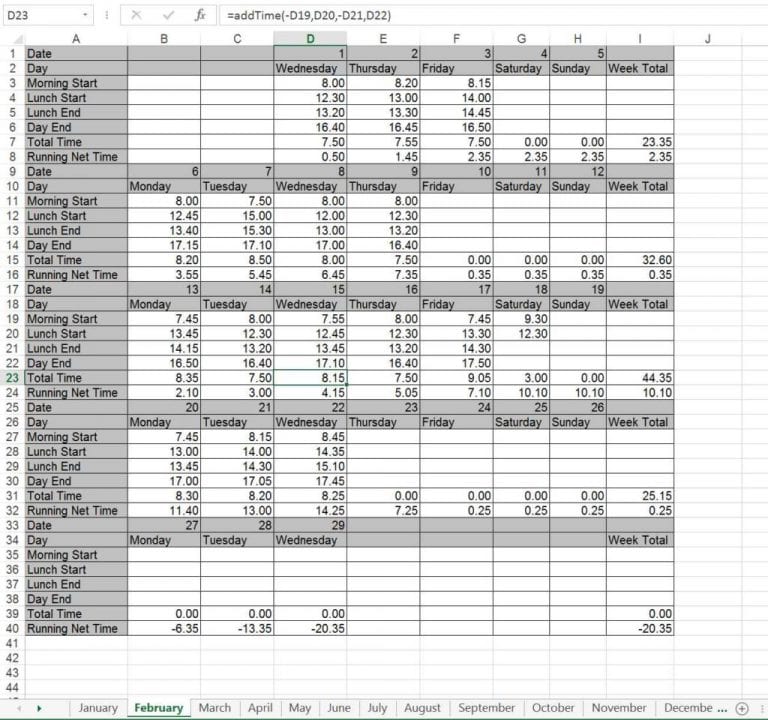

#Cash flow spreadsheet template update

This spreadsheet allows you to create and update an all-in-one personal financial statement that includes:

0 kommentar(er)

0 kommentar(er)